What Is The Social Security Wage Base For 2024

What Is The Social Security Wage Base For 2024. Social security wage base 2024 increase. You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

If you earn more than $160,200 this year,. Ssa has announced the 2024 social security taxable wage base.

In 2024, The Social Security Wage Base Limit Rises To $168,600.

As of january 1, 2024, the social security (full fica) wage base will increase to.

Social Security And Medicare Wage Bases And Rates For 2024.

The maximum social security employer contribution will increase by $520.80 in 2024.

The Social Security Administration Has Announced The Social Security Tax Wage Base For 2024 Will Be $168,600, An Increase Of $8,400 From The $160,200 Figure Used In.

Images References :

Source: valareewflora.pages.dev

Source: valareewflora.pages.dev

Tax Calculator California 2024 Barb Marice, Time to update your payroll system: Ssa has announced the 2024 social security taxable wage base.

Source: what-benefits.com

Source: what-benefits.com

Are My Social Security Benefits Taxable Calculator, Social security tax rate for employees. The oasdi tax rate for wages paid in 2024 is set by statute at 6.2 percent for employees and employers, each.

Source: financialsolutionadvisors.com

Source: financialsolutionadvisors.com

Social Security Wage Base 2024, The social security wage base will rise in 2024 to $168,600, a 5.2% increase from its 2023 wage base of $160,200. This means that any income you.

Source: lannaqdeloris.pages.dev

Source: lannaqdeloris.pages.dev

Social Security Wage Limits 2024 Avie Melina, For 2023, the wage base is $160,200. Attention taxpayers…starting january 1, 2024, the social security wage base will jump to $168,600 for payroll taxes.

Source: 45.144.30.39

Source: 45.144.30.39

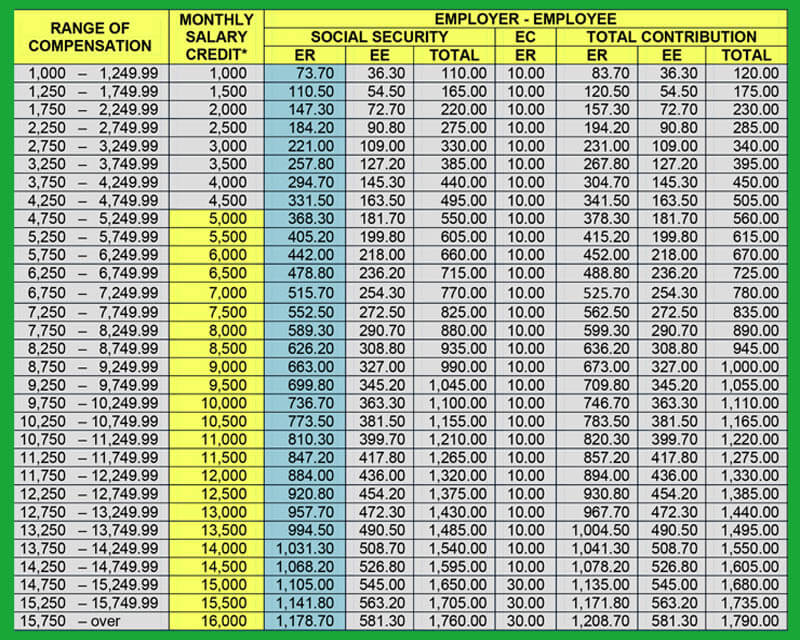

Updated SSS Contribution Table for 2019 HowToQuick Net, You aren’t required to pay the social security tax on any income beyond the social security wage base limit. The wage base limit is the ceiling on how much of your earnings are taxed for social security each year.

Source: skpadvisors.com

Source: skpadvisors.com

2022 Social Security Wage Base SKP Accountants & Advisors, LLC, For earnings in 2024, this base is $168,600. In 2024, the social security wage base limit is set to rise to $168,600.

Source: www.gggllp.com

Source: www.gggllp.com

Social Security Wage Base and Earnings Test Amounts Increase in 2023, You aren’t required to pay the social security tax on any income beyond the social security wage base limit. Attention taxpayers…starting january 1, 2024, the social security wage base will jump to $168,600 for payroll taxes.

Source: www.harpercpaplus.com

Source: www.harpercpaplus.com

Employers In 2023, the Social Security wage base is going up » Harper, After an employee earns above. For 2023, the wage base is $160,200.

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png) Source: ellyqrochella.pages.dev

Source: ellyqrochella.pages.dev

What Is The Social Security Earnings Limit For 2024 Amii Lynsey, Social security wage base for 2024. The social security administration has announced the social security tax wage base for 2024 will be $168,600, an increase of $8,400 from the $160,200 figure used in.

Source: www.landmarkcpas.com

Source: www.landmarkcpas.com

Social Security Wage Base Will Increase in 2022 Landmark, What is the social security limit ? In 2024, the wage base limit is $168,600.

The Social Security Administration (Ssa) Recently Announced That The Wage Base For Computing Social Security Tax Will Increase For 2024 To $168,600.

For 2023, the wage base is $160,200.

After An Employee Earns Above.

Using the “intermediate” projections, the board projects the social security wage base will be $167,700 in 2024 (up from $160,200 this year) and will.