Nebraska Tax Brackets For 2024

Nebraska Tax Brackets For 2024. On may 31, 2023, nebraska governor jim pillen signed lb 754 into law, which included a reduction of individual income taxes incrementally by 2027. Nebraska adjusts the brackets for inflation each year.

“nebraska also will be lowering the top tax rate between now and 2027, ultimately reducing the top rate from 6.84% in 2022 to 3.99% in 2027,” klintworth noted. (6) for taxable years beginning or deemed to begin on or.

Nebraska Has A Progressive Income Tax System, Meaning You Pay Taxes Based On Your Taxable Income.

For example, some residents will pay less income tax in 2024 due to a gradual reduction of the state's top income tax rate through 2027.

The Salary Tax Calculator For Nebraska Income Tax Calculations.

(6) for taxable years beginning or deemed to begin on or.

The Calculator Is Updated With The Latest Tax Rates And Brackets As Per The 2024 Tax Year In Nebraska.

Images References :

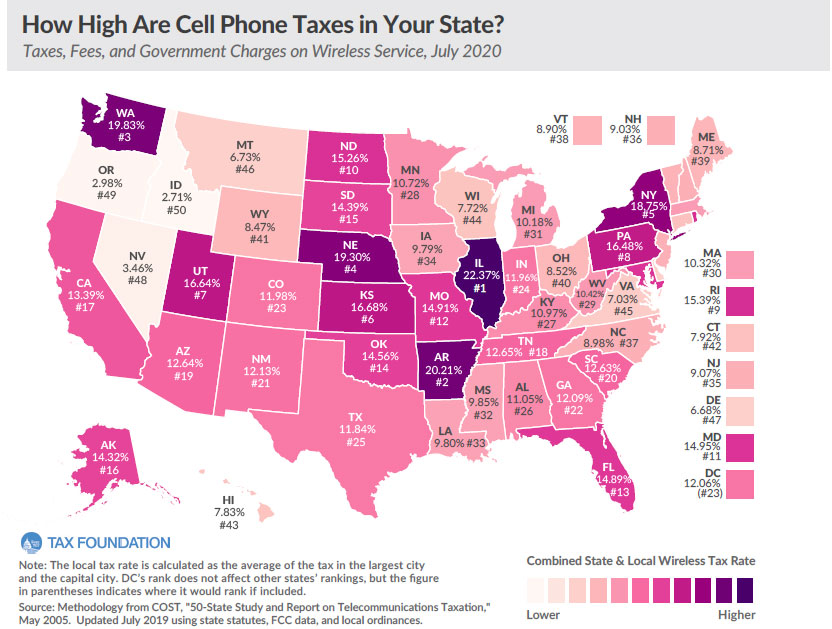

Source: platteinstitute.org

Source: platteinstitute.org

Nebraska has 4th highest wireless tax burden in the nation, Delivers full tax exemption for social security benefits a year early in 2024;. Nebraska adjusts the brackets for inflation each year.

Source: www.tax-brackets.org

Source: www.tax-brackets.org

Nebraska Tax Brackets 2024, Individuals must pay nebraska personal income tax at graduated rates based on 4 income brackets. Income tax brackets, rates, income ranges, and estimated taxes due.

Source: raniquewlexie.pages.dev

Source: raniquewlexie.pages.dev

Tax Brackets 2024 What I Need To Know.Gov Milka Suzanna, Updated for 2024 with income tax and social security deductables. The nebraska tax calculator includes tax.

Source: www.zrivo.com

Source: www.zrivo.com

Nebraska Tax Brackets 2024, The nebraska department of revenue is issuing a new nebraska circular en for 2024. The salary tax calculator for nebraska income tax calculations.

Source: www.zrivo.com

Source: www.zrivo.com

Nebraska Tax Brackets 2024, On may 31, 2023, nebraska governor jim pillen signed lb 754 into law, which included a reduction of individual income taxes incrementally by 2027. 2024 federal income tax brackets and rates.

Source: jeaninewfred.pages.dev

Source: jeaninewfred.pages.dev

Irs 2024 Standard Deductions And Tax Brackets Loni Marcela, This tool is designed for simplicity and ease of use, focusing solely on income. Updated for 2024 with income tax and social security deductables.

Source: www.taxuni.com

Source: www.taxuni.com

Nebraska Tax Brackets 2024, (6) for taxable years beginning or deemed to begin on or. In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: www.retirementliving.com

Source: www.retirementliving.com

Nebraska Tax Rates 2024 Retirement Living, 2024 federal income tax brackets and rates. In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

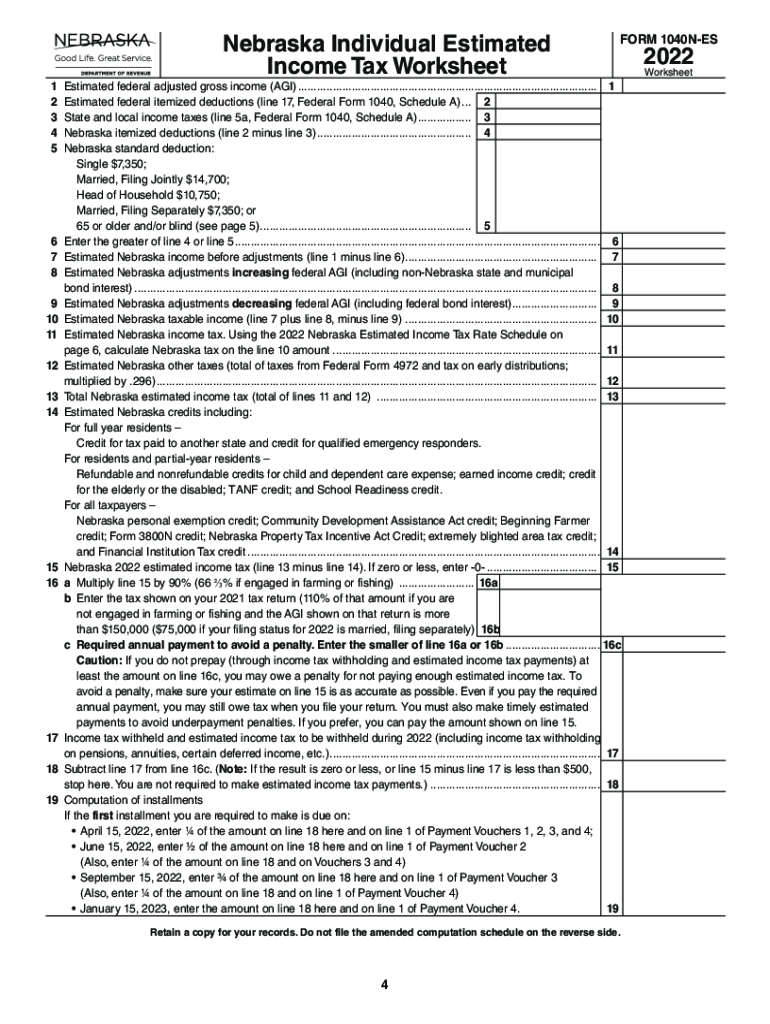

Source: www.dochub.com

Source: www.dochub.com

2022 nebraska tax Fill out & sign online DocHub, Nebraska has a progressive income tax system, meaning you pay taxes based on your taxable income. Updated for 2024 with income tax and social security deductables.

Source: www.zrivo.com

Source: www.zrivo.com

Nebraska Paycheck Calculator 2023 2024, The salary tax calculator for nebraska income tax calculations. Income tax brackets, rates, income ranges, and estimated taxes due.

On May 31, 2023, Nebraska Governor Jim Pillen Signed Lb 754 Into Law, Which Included A Reduction Of Individual Income Taxes Incrementally By 2027.

The nebraska department of revenue is issuing a new nebraska circular en for 2024.

By The Aarp Bulletin , July 01, 2022 12:00 Am.

This marginal tax rate means that your immediate additional income will be taxed at this rate.